| Host | Korea TC – ASEAN+3 Macroeconomic Research Office(AMRO) – OECD |

| Date | 25-27 September, 2024 |

| Time | All Day |

| Type | In-person |

| Venue | Vientiane, Lao PDR |

| Attendees | Tax officials from the Tax Department, Ministry of Finance of Lao PDR |

Main Contents

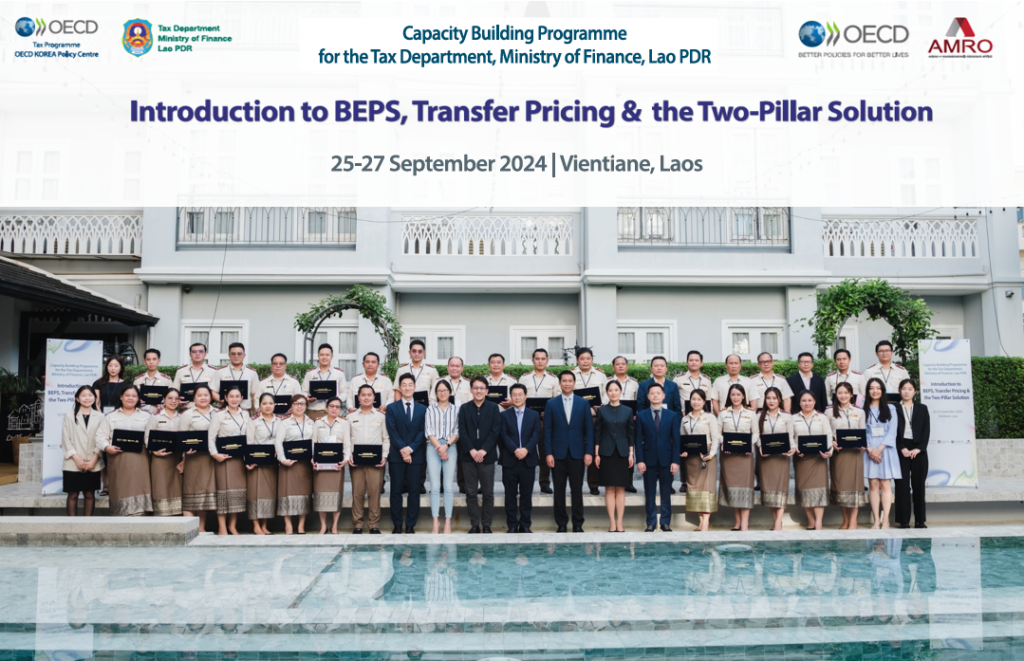

The Korea Tax Centre(KTC) held the second session of the Capacity Building Programme for the Tax Department, Ministry of Finance, Lao PDR. The workshop focused on the topic of Base Erosion and Profit Shifting(BEPS), Transfer Pricing & the Two-Pillar Solution. The programme was held in cooperartion with the OECD and the ASEAN+3 Macroeconomic Research Office(AMRO) in Vientiane, Lao PDR from 25-27 September, 2024. The workshop provided an overview of the BEPS project, with a focus on BEPS minimum standards and BEPS actions relating to Transfer Pricing(TP), as well as an overview of the Two-Pillar Solution to address the tax challenges arising from digitalisation (the Two-Pillar Solution) with a focus on the fundamental aspects of the Global Anti-Base Erosion (GloBE) model rules and their background. The programme was attended by 32 tax officials from the Tax Department, Ministry of Finance, Lao PDR and all the participants enthusiastically posed questions to the speakers and actively engaged in the discussions throughout this 3 day programme. Ms. Kaidi Liu, Advisor at the OECD has provided an active learning experience to the participants on the topic of Transfer Pricing and the Two-Pillar Solution. Korean experts, Ms. Soojin Lee and Mr. Ilhwoan Choi delivered comprehensive lectures on Transfer Pricing, Country by Country Reporting(CbCR) and Pillar 2. As a second session of the Capacity Building Programme for Lao PDR, this programme marked a successful finale of the collaboration between OECD, Korea Tax Centre(KTC) and AMRO(ASEAN+3 Macroeconomic Research Office) which started since 2023. |