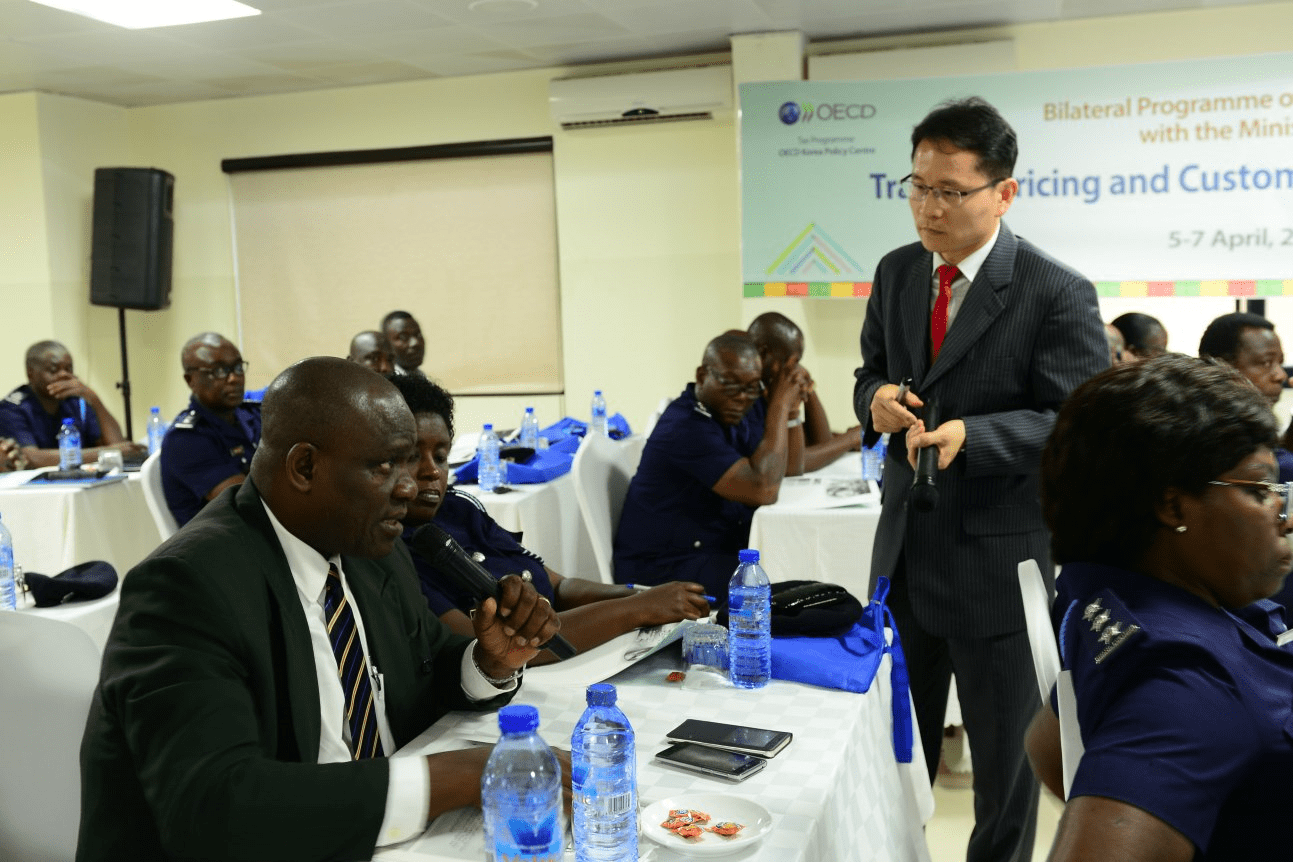

The Tax Programme in the OECD Korea Policy Centre has hosted a bilateral programme with Ministry of Finance, Ghana on 5-7 April 2016 in Accra, Ghana. This event has strengthened the capabilities of tax officials from Ministry of Finance Ghana in the area of Transfer Pricing and Customs Valuation-Korea’s Experiences.

This workshop has explored how customs and direct taxation authorities can work together to improve taxpayer compliance with regimes and provide taxpayers with a more joined-up and consistent approach. Through use of case studies and Korea’s experiences, this seminar has considered the processes countries have in place for the administration of their customs valuation and transfer pricing regimes, and explored how the two regimes might cooperate to support compliance and ensure consistency of approach. The event has encouraged closer alignment between customs valuation and transfer pricing.

Participants have gained a good understanding of the provisions of transfer pricing and customs valuation and familiarized themselves with main topics. Accordingly, the seminar has improved their roles as the tax economist and officials for the government. The seminar has given a great opportunity to all the participants from Ministry of Finance to build their capacities in the matter of taxation. Overall, the seminar has provided Korean experts to enlarge their views on the field of taxation through sharing ideas and discussing related issues with the participants, and the participants also have gained advanced knowledge and enhanced understanding in the basics and best practices.

These are the main discussion topics during the seminar as follows.

– Recent Development of the BEPS Project and Current Issues

– Tax Information System: E-Tax System of Korea

– Introduction to Korea Customs Services and UNIPASS

– Transfer Pricing: An Introduction

– Transfer Pricing Adjustment: Documentation and Transaction Value

– Recent Development in Transfer Pricing: BEPS Projects

– Customs Perspective in Transfer Pricing

– Alignment Mechanism for TP and Customs Valuation-Korea’s Perspective

– Import Duties and Border Adjustment-Korea’s experiences

Tax Programme, OECD Korea Policy Centre