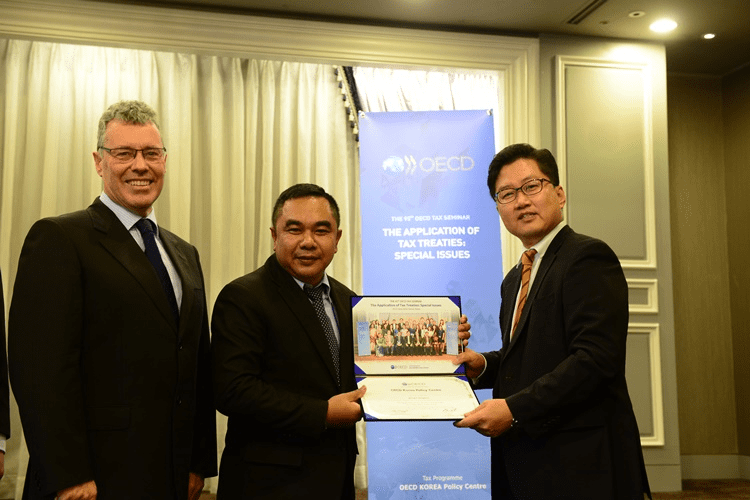

The 95th tax seminar has been conducted in Seoul from June 20th to 25th. This seminar has provided participants with a working knowledge of the application and interpretation of Tax Treaties. The seminar has therefore been especially useful for officials who are involved with the application of tax treaties, consideration of competent authority issues and the negotiation of tax treaties for their countries.

In addition to a general overview of the provisions included tax treaties, the seminar has focused on the key treaty provisions relating to the taxation of business profits, employment income, investment income, digital transactions and intellectual property. It has also highlighted OECD’s recent work on Base Erosion and Profit Shifting (BEPS) including initiatives to combat treaty abuse.

The seminar was orientated towards practical issues and involved the consideration of case studies and issues that participants have encountered in their work. Expert instructors have provided short lectures and guide discussions of the issues raised in the case studies.

Following are the main issues discussed during the seminar

– Role and content of tax treaties

– Entitlement to the benefits of tax treaties (Articles 1, 2, 4)

– Overview of OECD’s work on Base Erosion and Profit Shifting (BEPS)

– Taxing business profits: permanent establishment definition (PE) (Article 5)

– Interpretation of tax treaties and treaty obligations

– Permanent establishment definition continued

– Taxing business profits: Attribution of profits to PEs (Article 7)

– Taxing cross-border digital transactions

– Taxing income from immovable property and capital gains

– Taxing income from personal services (Articles 14, 15, 16, 17, 18, 19 and 20)

– Treaty shopping and beneficial ownership

– Treatment of dividends and interest

– Treatment of royalties, rents, know-how and software

– Countering abuse of treaties

– Countering abuse of treaties [continued]

– Proposed multilateral Instrument to implement the treaty changes

Tax Programme, OECD Korea Policy Centre