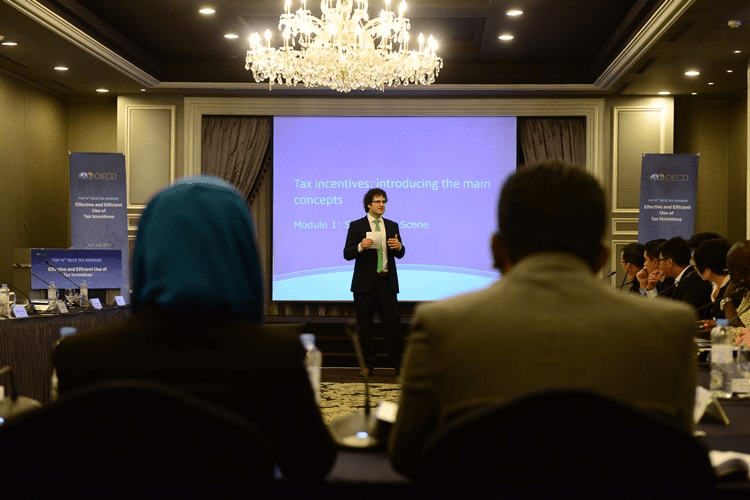

The OECD Korea Policy Centre has held the tax seminar in Seoul from July 4th to 9th. The main topic for the seminar has included effective and efficient use of tax incentives.

Countries use tax incentives for a variety of reasons, including stimulating domestic or foreign investment encouraging particular types of activity. While incentives are commonly observed, their contribution to the avowed policy objective frequently is small and distributional impacts adverse.

Thus, the seminar gives rise to two policy questions:

– First, when should tax incentives be used in preference to other policy tools?

– Second, when they are used, how should tax incentives be designed to maximize their chances of success?

Accordingly, this workshop has discussed state of the art of economic analysis of tax incentives, with the aim of providing participants with the best available tools to answer the two questions in specific cases.

Here are the main issues dealt with during the seminar,

– Tax Incentives

– A Framework for Analysis: Economics of tax incentives

– A Framework for Analysis: Principles for policy design

– Guidance on Effective and Efficient Use of tax incentives

Tax Programme, OECD Korea Policy Centre