The Tax Programme at the OECD Korea Policy Centre has conducted the 102nd tax seminar regarding ‘Latest Developments in Tax Administration of Large Business’ from June 12th to 17th in Seoul.

For this seminar, four experts from the OECD and its member countries have joined the event to provide lectures and discuss recent issues related to large tax payers. Also, around thirty participants of developing countries from Asia Pacific region to Africa have come to the seminar and actively involved in the event by sharing their experiences, policies and technical tools in order to hinder the base erosion caused by large business’s harmful tax practices.

Large business taxpayers are of critical importance to the economies in which they operate. They produce the majority of export income, provide a large share of the tax revenue and, in many economies, provide the majority of jobs. Due to its important characteristics, experts and participants have passionately engages in lectures, discussion and country presentations. They have dealt with the realistic issues by going through actual cases and sharing their field experiences.

The workshop have explored the current trends in managing large business taxpayers compliance risks, which focused on risk management, international collaboration, cooperative compliance and tax certainty.

The topics covered include:

· o Large Business as a specific segment

– Characteristics of Large Business Taxpayers (LBT)

– Importance of Large Taxpayers

– Identification and Selection of Large Business (Definition and Criteria used)

· o Organisational arrangements dealing with LBT

– General overview of the international practices for the Management of Large Business

– Organizational Structure and Management of LBT Units

– Responsibilities, mission and vision statements of LBT Units

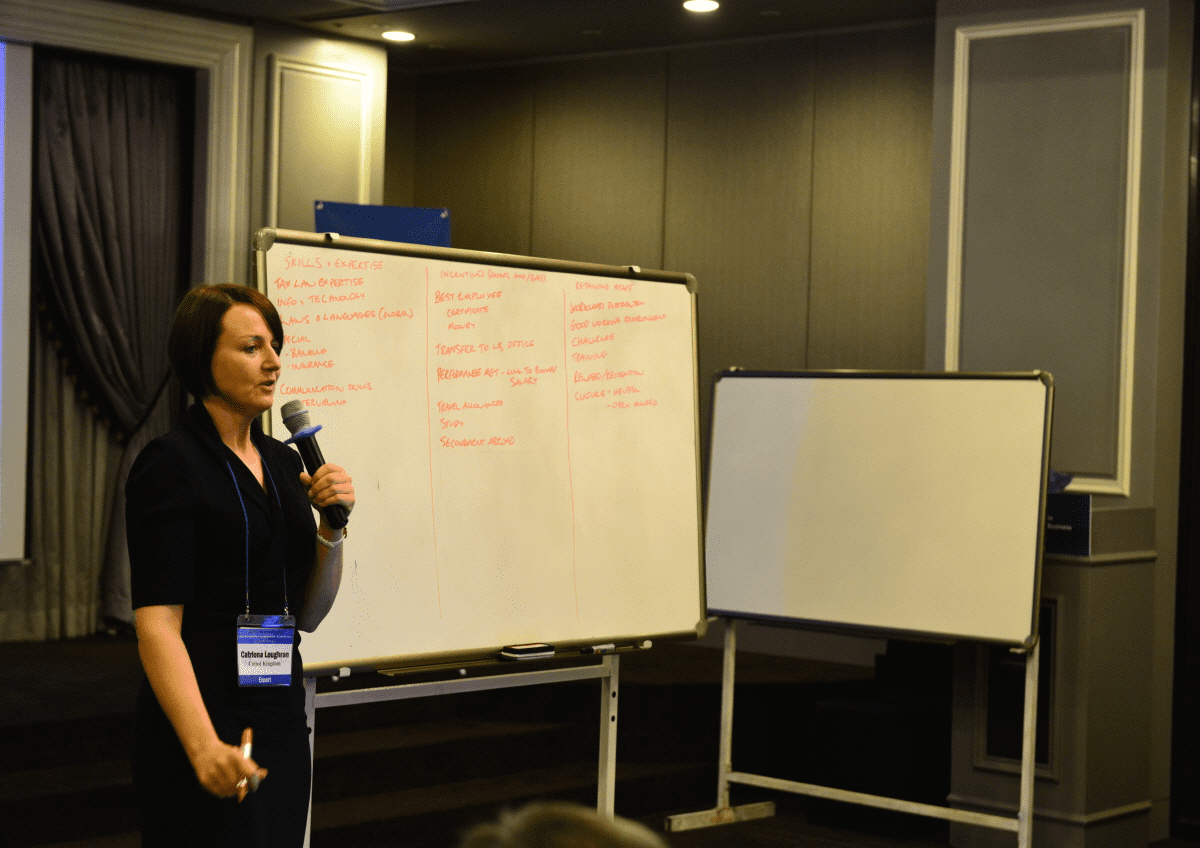

– Staffing, skills and expertise required for LBT Units

· o Managing LBT compliance risks

– Compliance Risk Management: principles and practises

– Improving Taxpayer’s compliance: a strategic approach

– Managing risk assessment in a CBC reporting scenario

– Developing a compliance program for Large Business

– Auditing of Large Business, Multi-Nationals and associated issues

· o International collaboration

– Using the Multilateral Assistance Convention

– The Global Awareness Guide and MAP

· o Co-operative compliance

– Relationship building

– The tax control framework,

– Real-Time Management Approaches and Providing certainty to Large Business

– Corporate Governance

o Tax certainty

Tax Programme, OECD Korea Policy Centre