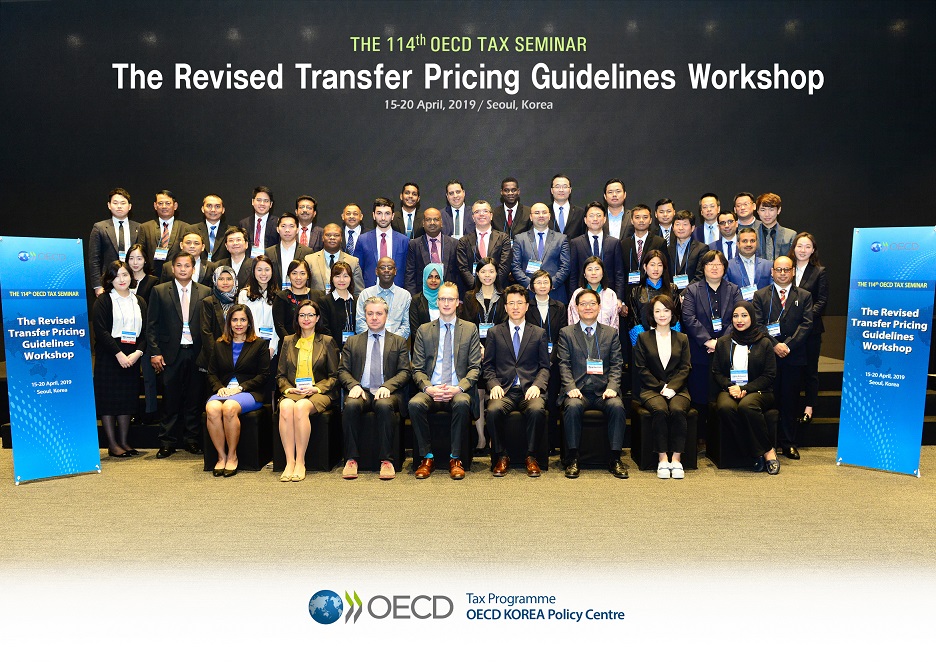

The Tax Programme of the OECD Korea Policy Centre (KPC) and OECD co-organized the 114th Tax Seminar on April 15-29, 2019, at the Glad Hotel in Seoul, Korea.

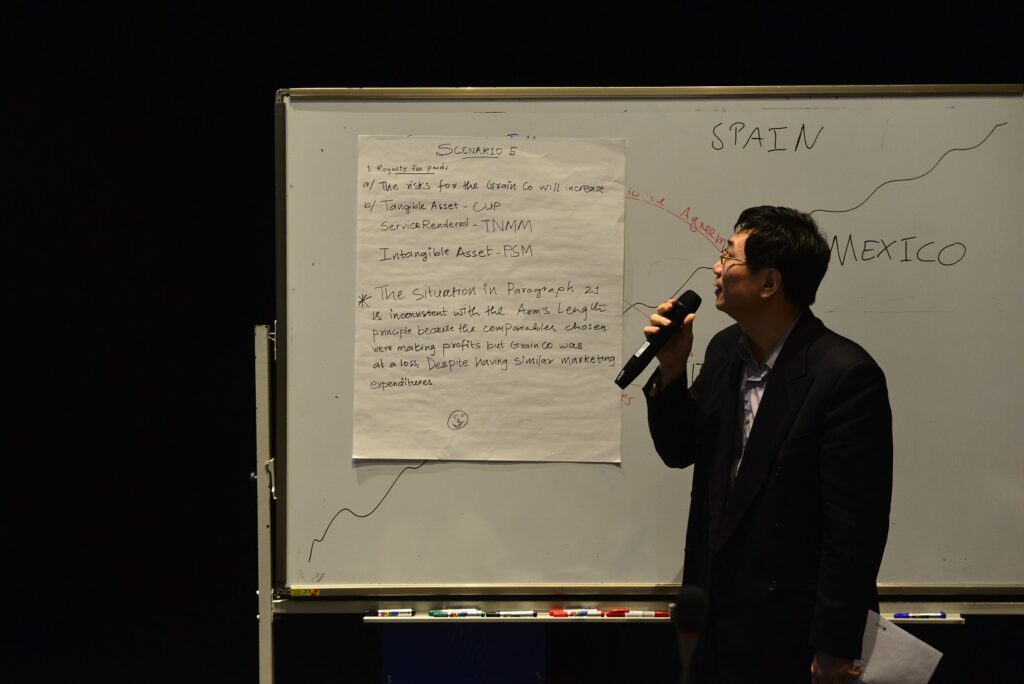

With its agenda “Transfer Pricing Guidelines”, the seminar discussed the major amendments to the recently revised OECD Transfer Pricing Guidelines and their application in practice. The seminar introduced the OECD’s guidelines on transfer pricing taxation to prevent tax avoidance, offshoring of taxable income through transfer pricing manipulation, and the implementation status of the OECD/G20 BEPS project, and shared the latest information on transfer pricing taxation and examples of countries’ initiatives. Participants from emerging economies with active multinational enterprise entry found the topic to be highly helpful in transfer pricing audits and pricing.

The seminar was led by Mr. Norman Wingen (OECD), Ms. Danijela Lulic (Australia), and Mr. Gavin Hales (Canada). In addition, more than 30 officials from 17 developing countries in the Asia-Pacific region engaged in enthusiastic discussions.

Tax Programme, OECD Korea Policy Centre