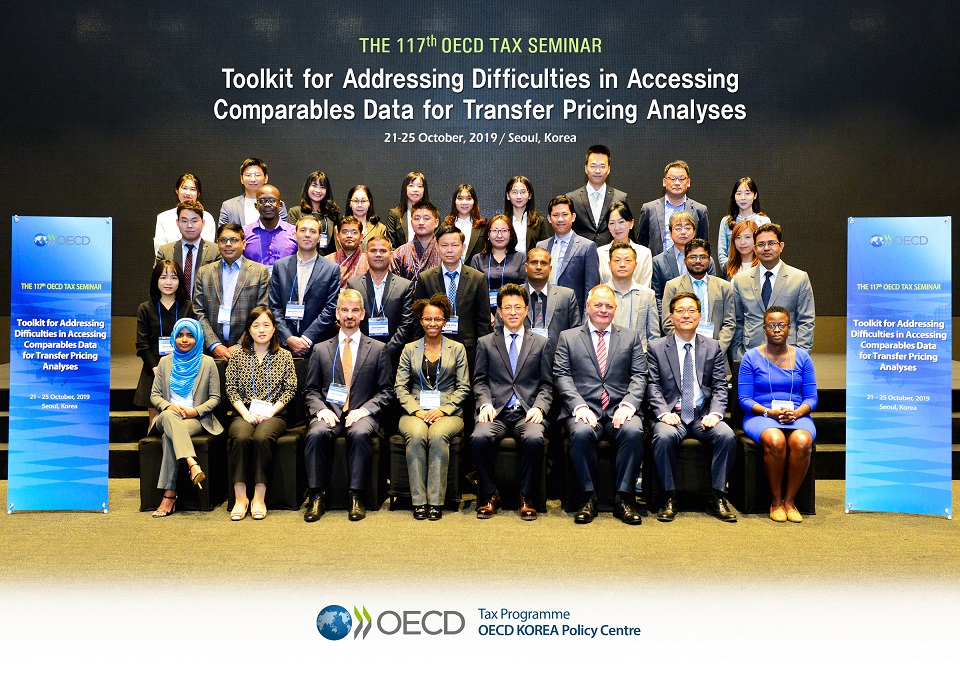

The Tax Programme of the OECD Korea Policy Centre (KPC) and OECD co-organized the 117th Tax Seminar October 21-25, 2019, at the Garden Hotel in Seoul, Korea.

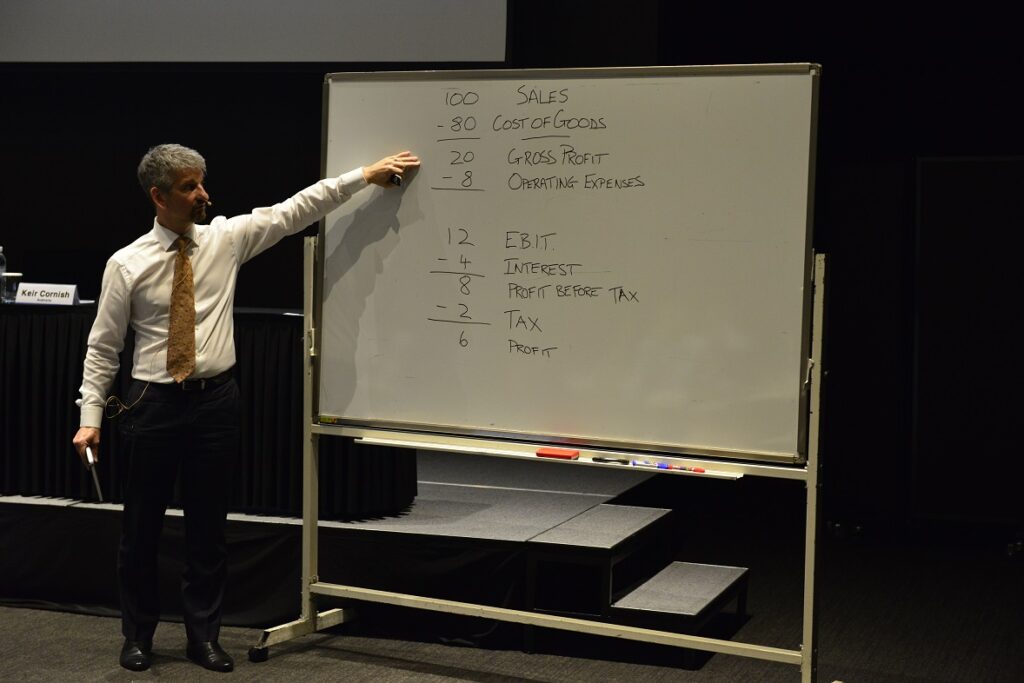

The seminar covered the recently developed Toolkit for Transfer Pricing Analysis, discussing in depth the basic theories of transfer pricing, the rules for calculating arm’s length price according to the type of transaction and type of business, and its application. In particular, the seminar addressed cases where Comparable Arm’s Length Prices are not readily available for calculating arm’s length prices.

The seminar was led by experts Ms. Wanda Montero Cuello (OECD), Mr. Anthony Clark (UK), and Mr. Keir Cornish (Astralia). The seminar was attended by more than 30 tax officials from OECD member countries and non-member countries.

Tax Programme, OECD Korea Policy Centre